The Charm and the Challenges: What No One Tells You About Buying a Listed Building

Whatever the grade of your building, its listed status denotes it as a property of national importance & interest, BUT living with history has unique consequences and responsibilities.

So grab yourself a cuppa and settle in whilst I share what I’ve learned in my year of owning a listed building.

Dinghurst Dreams

Our Grade 2 listed Farmhouse in North Somerset.

Buying a listed property is not the same as buying a conventional house. It requires foresight, patience and a clear understanding of the obligations that come with ownership.

Below are key considerations to help you make an informed, confident decision.

What is a listed building?

Lets start right at the beginning; a listed property is protected by law due to its special architectural or historic interest. In England, buildings are typically graded:

Grade I – buildings of exceptional interest

Grade II* – particularly important buildings of more than special interest

Grade II – buildings of special interest (the most common)

The listing applies not just to the façade, but often to the interior, fixtures, outbuildings and sometimes even boundary walls. Always assume that more is protected than you expect. Just because it is referenced on the national listing register does not mean it won’t need permission

Planning & Conservation Officers

Not all Planning & Conservation Officers are created equal, some are much more accommodating of requests than others! This does make following rules a little tricker so as a general rule ask!

In North Somerset (check your Local Authority as all work differently) we have the ability to pay for visits and reports ahead of submitting planning applications providing guidance. Be warned though, wait lists for these services are long (and chargeable) so ensure you allow sufficient time before work commences for these to occur.

Embrace a Different Renovation Mindset

Listed properties demand a sensitive, conservation led approach. The goal is not to make the building “perfect”, but to respect its history while making it comfortable for modern living.

This means:

Repair rather than replace

Retain original features wherever possible

Accept uneven floors, quirks and patina

Integrate modern services discreetly

Flexibility and respect for the building’s story will ultimately lead to a more rewarding outcome.

Join the Listed Property Owners Club

This organisation provides an invaluable membership providing an advice service dedicated to helping the owners of listed buildings.

You receive a bi-monthly magazine full of useful articles, free tickets to the bi-annual Listed Property Show, access to specialist suppliers and access to a wealth of practical, independent help to assist you with all the decisions you have to take at every stage of your ownership.

Insurance

Insurance costs are much higher with a listed building as rebuild costs are also higher.

We went from paying £220 annually in our 1990’s estate home to over £1,600 a year to insure our new property, a cost worth knowing prepurchase!

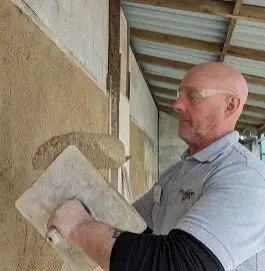

Specialist Trades

You will need specialist trade which often are more expensive. They may also have longer wait times.

From builders to designers, ensure everyone involved has proven experience with listed buildings.

The wrong advice or materials can cause long-term damage and may be difficult (and expensive) to undo.

The Reward: Living in Something Truly Special

While buying a listed property requires careful thought, the rewards are significant. These homes offer individuality, craftsmanship and a deep sense of place that cannot be replicated.

With the right preparation, professional guidance and a realistic mindset, owning a listed property can be not only manageable, but deeply fulfilling.

Would you buy a listed property? Perhaps you already own one. I love hearing about your experiences so hit reply to share!